The world can be a scary place. It’s full of risks, uncertainties, and looming crises. But you don’t need to cower from it! Instead, read these ten books on finance and personal economics that will arm you with the power to take control of your finances for good.

These aren’t your typical personal finance books that tell you to spend less and save more. Instead, these books will give you insights into the world of finance and how it contributes to your life.

If you already have a grip on some basics about money and personal finances, this post is for you. But if not, read through the whole article once before digging into any specific book. There will be a lot here (most of it is from personal experience) that might be new information for you!

3 keys to getting rich: mindset, tools, and network

Start off by learning to find value in things that aren’t easy or cheap

“You’re rare, like an ancient coin.

Let’s see those 10 books which can make you rich!

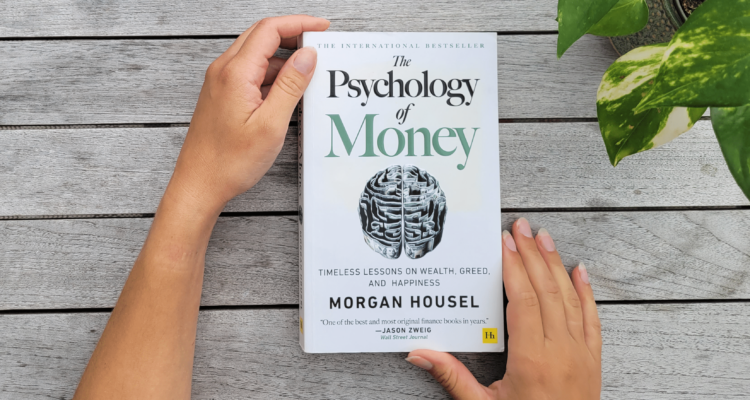

1. The Psychology of Money by Morgan Housel

In the Psychology of Money, Morgan Housel teaches you how to have a better relationship with money and to make smarter financial decisions. Instead of pretending that humans are ROI-optimizing machines, he shows you how your psychology can work for and against you.

Key Takeaways:

- Being greedy can turn out to be the biggest financial mistake you’ll ever make.

- Envy has no place in the money market, as it can blur your thinking.

- Our early experiences with money determine our financial decisions later on.

Buy it from Amazon: Kindle Edition | Audiobook | Hardcover | Paperback

2. Money: Master The Game by Tony Robbins

MONEY: Master the Game is based on extensive research and one-on-one interviews with more than 50 financial experts. The result is a 7-step blueprint for securing financial freedom. Tony Robbins guides readers, of every income level, through the steps to become financially free by creating a lifetime income plan. This income plan is supported by a sneak peek into the portfolio of one of the most successful investors in history, Ray Dalio.

Key Takeaways:

- Do not underestimate the exponential power of compound interest.

- Choose your financial goals wisely – pick one from the five major goals and stick to it to help yourself believe that financial freedom is achievable.

- Use the three-bucket system to diversify your investments.

- Remember to always measure your finances to ensure that you know how much you are earning, investing, and spending. This can help you organize better and, ultimately, attain financial freedom.

- Make yourself recession-proof by developing key skill sets which will come in handy in all types of markets.

- Do not try to solve all your financial woes at once. Instead, invest 10 minutes, every day, to identify three expenses that can be eliminated from your routine. Once decided, stick to the same.

- Remember to execute what you read. Having knowledge is not the end goal, learn to utilize it towards achieving financial freedom.

Buy it from Amazon: Audio CD | Hardcover | Paperback

3. You Need a Budget by Jesse Mecham

This book is for anyone who has ever tried to budget and failed. If you think budgeting is rigid and suffocating, this book will change your perspective. If your family wants to get out of debt, break the paycheck-to-paycheck cycle, or be able to pay for a family vacation without credit cards, You Need A Budget can get you there!

Key Takeaways:

- When you don’t have the clarity to see how you’re doing, you can’t see the simple changes that would make things a whole lot better.

- When You Don’t Know Where You Stand, You Don’t Know What You’re Capable Of

- Thirty minutes should be plenty of time to recap the prior month and set a plan for the one ahead. You’ll get better at this the more you do it.

Buy it from Amazon: Kindle Edition | Hardcover | Paperback

4. Rich Dad Poor Dad by Robert T. Kiyosaki

Rich Dad Poor Dad is about Robert Kiyosaki and his two dads—his real father (poor dad) and the father of his best friend (rich dad)—and the ways in which both men shaped his thoughts about money and investing. He says that his poor dad went to Stanford and earned a Ph.D., and his rich dad never finished the eighth grade. The book consists of 8 chapters, lessons that everyone must learn. The central message conveyed by Kiyosaki is that you don’t need to earn a high income to be rich.

Key Takeaways:

- Six lessons Robert Kiyosaki learned from his Rich Dad about making money and the mistakes that Poor Dad made

- Five obstacles to overcome before you can become rich and stay rich

- Ten steps to follow to develop your financial genius

- Actionable to-do steps you can put to work right away

Buy it from Amazon: Kindle Edition | Audiobook | Paperback

5. Think and Grow Rich by Napoleon Hill

Think and Grow Rich is the combined wisdom from more than 500 of America’s most successful individuals. Their insights were then narrowed down into 13 principles and contributed to what Hill refers to as an overall “Philosophy of Achievement.”

However, refusing to let Think and Grow Rich be defined purely as a method or system for success, Hill stated that the goals of his book were:

- To help the reader become self-aware.

- To help the reader understand how to become more effective amidst the immutable laws of the universe.

Key Takeaways:

- Every major achievement begins with an intense belief in one’s ability to accomplish it.

- You are who you think you are. Encourage positive thoughts and eliminate fear and doubt.

- Knowledge is only as good as the plans you have to use it.

- Persistence is insurance against failure.

- Make decisions quickly and do not be easily swayed by the negative opinions of other people.

Buy it from Amazon: Kindle Edition | Audiobook | Hardcover | Paperback

6. I Will Teach You To Be Rich by Ramit Sethi

This book teaches you various personal finance strategies and financial habits as part of a well-defined investment program that can help you set up self-sustaining wealth growth.

Key Takeaways:

- No one but ‘you’ is responsible for your financial problems.

- It is more important to get started than to become an expert – also known as the 85% rule.

- Start your investment journey today, no matter how little money you have.

- Understand and accept that it is okay to make mistakes in your financial journey.

- Realize that ordinary actions will only get you ordinary results; extraordinary steps are required for stupendous outcomes.

- Create a financial system where you spend extravagantly on buying things you love but cut costs in areas that do not interest you. This theory is also known as conscious spending.

- Remember, there’s a limit to how much you can cut your expenses. But, there is no limit to how much you can earn.

- Figure out how much money you earn and then automatically direct it to the different spending avenues, including savings accounts and investment options.

- Devise a financial system that works for you and once it’s set up, do not fiddle with it too much.

- While deciding on your financial goals and plans, play offense instead of being on the defense.

- Use your hard-earned money to design your rich life.

Buy it from Amazon: Kindle Edition | Audiobook | Paperback

7. The Compound Effect by Darren Hardy

The Compound Effect will show you why big, abrupt changes rarely work and how you can change your life over time with the power of small, daily steps, a routine that builds momentum, and the courage to break through your limits when you reach them.

Key Takeaways:

- Turn your life goals into daily habits.

- Come up with a routine and consistently show up to build momentum.

- When you hit a ceiling, use your momentum to push through, even if you have to cheat a little at first.

Buy it from Amazon: Kindle Edition | Audiobook | Hardcover | Paperback

8. Your Money or Your Life by Vicki Robin

Your Money or Your Life (1992) is a nine-step guide to taking control of your finances – so you can enjoy your life rather than just make a living. You’ll learn how to adjust your attitude toward your money and time, get out of debt, start saving, and ultimately reach Financial Independence.

Key Takeaways:

- Most people are making dying instead of making a living – spending their life having a job that wears them out and leaves no room for personal development.

- By treating the money we spend as trading our life energy we can become more conscious about the things we buy and especially about those that don’t bring us fulfillment.

- Tracking our spending is a gateway to a more fulfilled life where our purchases align with our meaning.

Buy it from Amazon: Kindle Edition | Audiobook | Paperback

9. The Intelligent Investor by Benjamin Graham

The Intelligent Investor is a book that aims to help people invest in the stock market while minimizing their economic risks. It focuses on longer-term and more risk-averse approaches. Graham focuses on investments (based on research) rather than speculations (based on predictions). The Intelligent Investor provides guidance on how to get involved in value investing and how you can prevent Mr. Market from dictating your financial decisions.

Key Takeaways:

- Economist Benjamin Graham, best known for his book The Intelligent Investor, is lauded as a top guru of finance and investment.

- Known as the father of value investing, The Intelligent Investor: The Definitive Book on Value Investing is considered one of the most important books on the topic.

- Graham’s method advises investors to concentrate on the real-life performance of their companies and the dividends they receive, rather than paying attention to the changing sentiments of the market.

- Graham also advocated for an investing approach that provides a margin of safety—or room for human error—for the investor.

- Most importantly, investors should look for price-value discrepancies—when the market price of a stock is less than its intrinsic value.

Buy it from Amazon: Kindle Edition | Audiobook | Paperback

10. The Total Money Makeover by Dave Ramsey

The book imparts elementary financial literacy and preaches ways to live a debt-free life. It uses step-by-step guidance to instill financial discipline among the readers.

Key Takeaways:

- It strongly advocates the idea of living life free of debt. Otherwise, we spend our lives as slaves to the lenders.

- By living within our means, we may quickly achieve a debt-free life.

Buy it from Amazon: Kindle Edition | Audio CD | Hardcover | Paperback

Conclusion

Having good financial knowledge can save you from financial disasters and make your life more stable and stress-free. Although these 10 aren’t enough to get whole financial knowledge if you are a beginner you should read these books.

Liked my contents? Read my blog on 10 must-have Laptop Accessories